Summary

Choosing a payment gateway is like picking a business partner—you want reliability, security, and no surprise fees! Make sure it fits your business size, supports your customers’ favorite payment methods, and integrates smoothly with your existing tools. Oh, and don’t forget security, because fraudsters are lurking. Compare fees, payout times, and customer support before making the call. The right choice means more sales, less stress, and getting paid without a hitch!

February 17, 2025

Picking the right payment gateway can make or break your business. Whether you’re running an online store, offering subscription services, or expanding your brick-and-mortar shop to the web, having a seamless and secure way to accept payments is essential.

But with so many choices out there, how do you find the perfect fit? In this guide, we’ll break it down and help you navigate the key factors to consider when choosing a payment gateway for your business.

Understand Your Business Needs

Before diving into different payment gateway options, assess your business model and needs:

- Transaction Volume: Are you a small startup, a growing business, or an enterprise-level company?

- Target Audience: Do your customers prefer credit cards, digital wallets, or bank transfers?

- Business Type: Are you selling physical products, digital goods, or subscription-based services?

Consider Security and Compliance

Security is a top priority when handling customer payments. Choose a payment gateway that offers:

- PCI-DSS Compliance: Ensures that payment information is handled securely.

- Fraud Detection & Prevention: Features like two-factor authentication, tokenization, and AI-driven fraud analysis.

- Encryption and Secure Payment Processing: End-to-end encryption to protect sensitive data.

Fun Fact: “Airbnb initially struggled with international transactions due to limited support from their first payment provider. They later switched to a more flexible solution, allowing them to scale globally. ”

Look at Payment Methods Supported

Customers expect a variety of payment options. Ensure that the gateway supports:

- Credit & Debit Cards (Visa, MasterCard Amex, Wise, etc.)

- Digital Wallets (PayPal, Apple Pay, Google Pay, Payoneer, etc.)

- Bank Transfers & ACH Payments

- Cryptocurrency Payments (if applicable to your business model)

Evaluate Integration & Compatibility

Your payment gateway should integrate seamlessly with your existing systems, such as:

- E-commerce Platforms (WooCommerce, Shopware, Magento, Shopify, etc.)

- Accounting Software (QuickBooks, Xero, etc.)

- Custom APIs for developers to integrate into bespoke platforms

Compare Fees & Pricing Structures

Payment gateways charge different types of fees. Compare:

- Transaction Fees: Usually a percentage + fixed fee per transaction (e.g., 2.9% + $0.30)

- Monthly Fees: Some gateways charge a flat monthly fee for premium services.

- Chargeback Fees: Fees incurred when a transaction is disputed by a customer.

- International Processing Fees: Additional costs for cross-border transactions.

Fun Fact: “Netflix had to rethink its payment strategy to accommodate recurring subscriptions across different countries, ensuring seamless billing while reducing payment failures.”

Check Settlement Time & Payout Frequency

Consider how quickly funds will be available in your business account. Some gateways offer:

- Instant payouts (with higher fees)

- 1-3 day settlement periods (standard for most providers)

- Rolling reserves for high-risk businesses

Review Customer Support & Reliability

Technical issues can impact your revenue. Choose a gateway with:

- 24/7 Customer Support via chat, phone, or email

- Comprehensive Documentation & Developer Support

- High Uptime & Reliability to avoid downtime-related losses

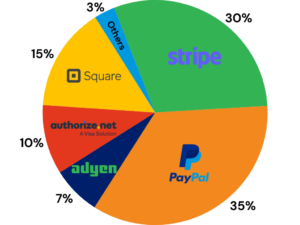

Popular Payment Gateway Options

Here are some of the most widely used payment gateways:

- Stripe: Great for developers and subscription-based businesses.

- PayPal: Trusted worldwide, ideal for e-commerce businesses.

- Square: Best for small businesses and point-of-sale integrations.

- Authorize.Net: Suitable for businesses needing multiple payment methods.

- Adyen: Preferred by global enterprises for international transactions.

Conclusion

Selecting the right payment gateway isn’t just another business decision—it’s the backbone of how you get paid! The right choice means smoother transactions, happier customers, and more money in your pocket. So take a moment to consider your needs, security requirements, and preferred payment methods before diving in.

Still unsure? No worries! Tell us what your business needs, and we’ll help you find the perfect match!

Related Blog

eCommerce Development

Shopware vs Shopify vs Adobe Commerce in 2026: Which One Should You Choose?

Shopware vs Shopify vs Adobe Commerce - Choosing the right eCommerce platform in 2026 is no longer just a technical decision; it’s a strategic growth decision. Whether you're a founder scaling a D2C brand, a CTO planning international expansion, or...

eCommerce Development

Top 5 Proven Seasonal Discount Tactics to Boost Your eCommerce Sales

Every eCommerce brand looks forward to seasonal spikes in sales. However, reducing prices simply because competitors are doing the same can quickly lead to a pricing war, where margins shrink and no one truly benefits. Seasonal discount pricing, when planned...

eCommerce Development

Dropshipping Business Model Explained: A Complete Beginner’s Guide

Welcome to this easy-to-understand guide on dropshipping, a popular and flexible way to start an online business without following traditional retail methods. In the digital age, dropshipping allows you to launch an eCommerce store without stocking or handling products yourself....

Keep up-to-date with our newsletter.

Sign up for our newsletter to receive weekly updates and news directly to your inbox.